Understanding Bankruptcy As a Debt Management Option For Seniors In Hawaii

As seniors face more and more financial burdens in Hawaii, they may have to start thinking about debt management. Medical bills start to mount up, credit card debt becomes overwhelming, and working to pay it all off becomes more difficult.

One option seniors can consider is bankruptcy. Chapter 7 bankruptcy eliminates unsecured debt while selling off non-exempt assets and Chapter 13 bankruptcy allows seniors to consolidate their debts and create a payment plan for financial relief. However, bankruptcy is not always the right choice which is why it’s important to consult with a Hawaii bankruptcy lawyer to see if it’s the right fit for you.

Do Seniors Need To File For Bankruptcy?

When facing overwhelming debt, filing for bankruptcy can be the right path, but is not always necessary. There are several factors that come into play, especially as a senior, in determining a path forward. Income and assets can have a role in determining a senior’s best steps forward.

The two situations that may make bankruptcy a poor choice are:

- The senior has nothing that can be seized by a creditor therefore making filing for bankruptcy unnecessary. The senior is “judgement proof” and cannot lose anything in a settlement.

- The senior has too many assets and will end up not qualifying for Chapter 7 so instead will be made to pay high payments in a payment plan due to the amount of assets.

If bankruptcy seems like the only answer, talk with a bankruptcy lawyer first. Some provide a free consultation, where they evaluate each case and can decide if an alternative method might be more advantageous. Alternative methods can include:

- Debt settlement

- State and federal assistance

- Credit counseling

- Ignoring certain debts

Issues To Consider Before Filing For Bankruptcy As a Senior Citizen

Deciding when to file for bankruptcy and when to pursue alternative solutions is not black and white. There are several issues that a Hawaii bankruptcy lawyer can help seniors consider before deciding to move forward with bankruptcy:

- Ensuring Income Protection: Social security, pensions, and retirement funds are usually protected from creditors being able to take them.

- Evaluating Home Equity: Hawaii has a homestead exemption, meaning primary residents may not be sold as an asset. However, if a home has high equity, it could be at risk in Chapter 7 bankruptcy.

- Debt Type: Not all debts are dischargeable at the end of a bankruptcy process. It’s important to evaluate whether your debts are actually able to be discharged. Unsecured debt like medical bills and credit cards typically can be discharged.

- Protecting Your Assets: Chapter 7 bankruptcy requires seniors to sell off their assets, which could have a significant impact on their lives. However, if all assets are exempt and creditors cannot obtain them, then it may be worth avoiding bankruptcy and simply ignoring the debt.

- Credit Impact: Bankruptcy affects a credit report for 7-10 years which can make it harder to get other loans or future housing.

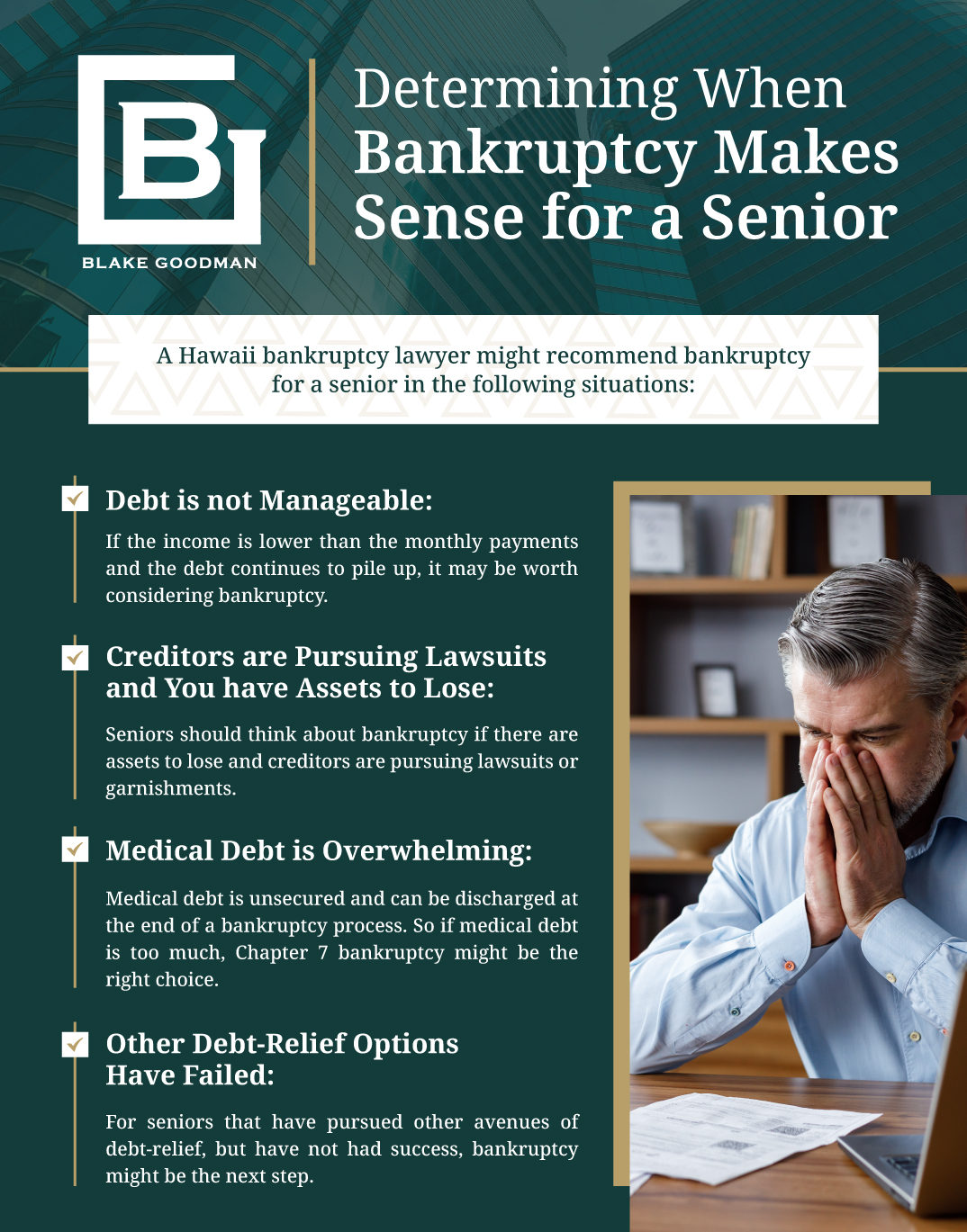

Determining When Bankruptcy Makes Sense For a Senior

A Hawaii bankruptcy lawyer might recommend bankruptcy for a senior in the following situations:

- Debt is not Manageable: If the income is lower than the monthly payments and the debt continues to pile up, it may be worth considering bankruptcy.

- Creditors are Pursuing Lawsuits and You have Assets to Lose: Seniors should think about bankruptcy if there are assets to lose and creditors are pursuing lawsuits or garnishments.

- Medical Debt is Overwhelming: Medical debt is unsecured and can be discharged at the end of a bankruptcy process. So if medical debt is too much, Chapter 7 bankruptcy might be the right choice.

- Other Debt-Relief Options have Failed: For seniors that have pursued other avenues of debt-relief, but have not had success, bankruptcy might be the next step.

How Seniors Can Protect Their Assets

For many, asset protection is a serious consideration when thinking about bankruptcy. In Hawaii, many assets are exempt, which means they cannot be sold to pay off your debts. Exempt assets include social security benefits, pensions, retirement accounts, a primary residence, primary vehicles, and more.

However, many assets will be affected which can change the quality of life for seniors. Non-exempt assets include excess home equity, multiple vehicles, luxury items, significant cash or investments, and non-essential property. These assets will likely be sold to pay debts. So how does someone protect their assets?

- Meet with a Hawaii bankruptcy attorney to use the maximum allowed state and federal exemptions.

- Keep social security payments in a separate account. Once they mix with other income, they can be taken for bankruptcy.

- Choose chapter 13 bankruptcy to create a payment plan instead of selling assets.

- Consider alternative debt-relief options such as debt negotiations.

Why Seniors Should Consult a Bankruptcy Lawyer Before Filing

Meeting with a bankruptcy lawyer can make a significant difference in how debt-relief plays out in the life of seniors. A bankruptcy lawyer will take a look at the specific situation and determine what alternatives might be available before pursuing bankruptcy.

A Hawaii debt relief attorney can help look into the exemptions that are allowed and make sure they are used the best way to protect as many assets as possible. They will stop harassment calls from creditors and will take the necessary action if creditors continue harassment after a bankruptcy filing. With this help and more, seniors can experience debt-relief with confidence knowing they are pursuing the best possible avenues.

Reach Out To Our Hawaii Bankruptcy Lawyers For The Debt-Relief You Need

With years of experience and training, our Hawaii bankruptcy lawyers are here to help you navigate the challenges of overwhelming debt as a senior. From knowing what steps to take to filing the necessary papers, you can have peace of mind knowing you are in the best hands and your bankruptcy will go smoothly and efficiently.

Contact us today for a free consultation and discover a new financial freedom.

Email: blake@debtfreehawaii.com

Website: https://www.debtfreehawaii.com/

HONOLULU OFFICE

900 Fort Street MallSuite 910

Honolulu, HI 96813

Phone: (808) 517-5446

AIEA OFFICE

98-1238 Ka'ahumanu StSuite 201

Pearl City, HI 96782

Phone: (808) 515-3441

KANEOHE OFFICE

46-005 Kawa StSuite 206

Kaneohe, HI 96744

Phone: (808) 515-3304

MAUI OFFICE

Our location has moved from

300 Ohukai RdSuite B317

Kihei, HI 96753

Phone: (808) 515-2037

to

220 Imi Kala St. #203B

Wailuku, HI 96793

Blake Goodman received his law degree from George Washington University in Washington, D.C. in 1989 and has been exclusively practicing bankruptcy-related law in Texas, New Mexico, and Hawaii ever since. In the past, Attorney Goodman also worked as a Certified Public Accountant, receiving his license form the State of Maryland in 1988.