Understanding The Impact Of Debts & Liens On Your Future After Bankruptcy

Bankruptcy can be beneficial for those involved in significant debt who are unable to pay it back. Bankruptcy gives the debtor a chance to use their assets to pay what they owe in return for a dismissal of the remaining debts. Or in other bankruptcy cases, you will be given a payment plan that must be completed within a certain timeframe. Once your payment plan is complete, your remaining debts may be dismissed.

While bankruptcy can eliminate the debts that you owe, it does not impact how liens will impact your property. A Honolulu bankruptcy attorney can take a look at your debts and liens to help you determine how they will impact you in the future.

What Is a Property Lien In Hawaii & How Does It Impact Bankruptcy?

A property lien is a legal claim placed on your assets by a creditor to secure a debt you owe. When you purchase property on credit—like a home, car, or other valuable assets—the lender places a lien on the item until the debt is fully paid. This means they have the legal right to repossess or force the sale of the property if you default on your payments.

In the context of bankruptcy, understanding property liens is essential because filing for bankruptcy may not automatically eliminate these liens. While bankruptcy can discharge your personal obligation to pay certain debts, liens might survive the bankruptcy process, allowing creditors to enforce them against your property.

Common Types Of Liens In Hawaii & Their Impact On Debt Relief

There are several different types of property liens:

- Mortgage Liens: When you take out a mortgage, the lender places a lien on your home. If you fail to make mortgage payments, the lender can foreclose on the property to recover the debt.

- Tax Liens: If you don’t pay your property taxes, the government can place a lien on your property. Tax liens have priority over other types of liens.

- Judgment Liens: Creditors who win a lawsuit against you for unpaid debts (like credit card bills or medical bills) can obtain a judgment lien on your property.

- Mechanic’s Liens (Construction Liens): Contractors or suppliers who perform work on your property and aren’t paid can file a lien to secure payment.

- Non-Purchase-Money Liens: These occur when you use personal property as collateral for a loan that wasn’t used to purchase the item itself.

How Liens & Secured Debt Are Handled In Bankruptcy

In bankruptcy, debts are classified as secured or unsecured:

- Secured Debts: Debts backed by collateral (e.g., a mortgage or car loan). The creditor has a lien on the property, giving them the right to repossess it if you default.

- Unsecured Debts: Debts without collateral (e.g., credit card debts, medical bills). Creditors have no specific property to claim if you don’t pay.

When you file for Chapter 7 bankruptcy, unsecured debts can be discharged, relieving you of personal liability. However, secured debts are treated differently because of the attached liens. Even after bankruptcy, liens may remain on the property, and creditors can enforce them unless specific actions are taken to remove them.

In Chapter 13 bankruptcy, you propose a repayment plan to pay back all or a portion of your debts over 3 to 5 years. This chapter offers more flexibility in dealing with liens, potentially allowing you to avoid or “strip” certain liens under specific conditions.

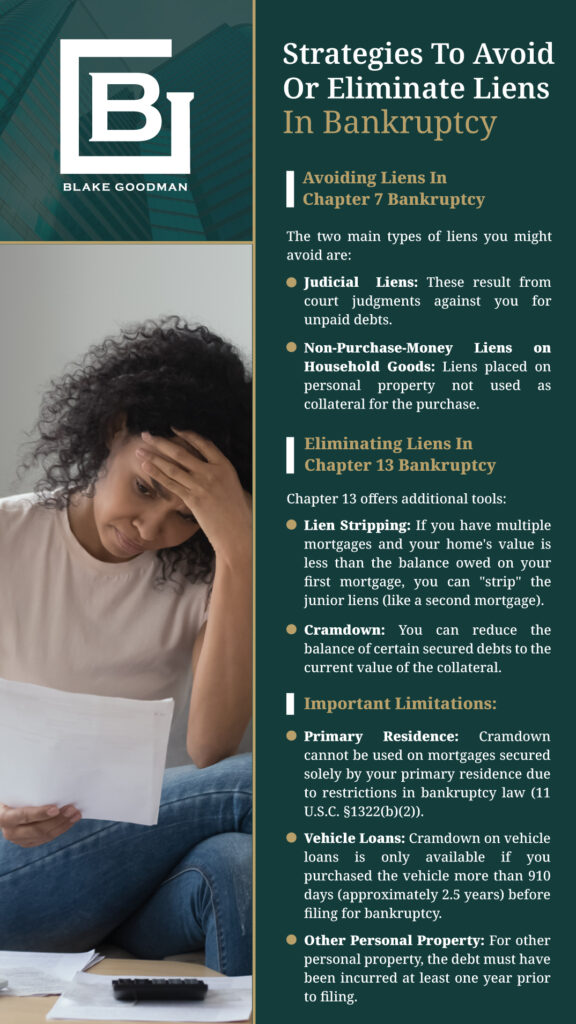

Strategies To Avoid Or Eliminate Liens In Bankruptcy

Avoiding Liens In Chapter 7 Bankruptcy

Under Chapter 7, you can avoid certain liens that impair exemptions you’re entitled to. The two main types of liens you might avoid are:

- Judicial Liens: These result from court judgments against you for unpaid debts.

- Non-Purchase-Money Liens on Household Goods: Liens placed on personal property not used as collateral for the purchase.

To avoid these liens, you must file a motion with the bankruptcy court demonstrating that the lien impairs an exemption you’re entitled to under state or federal law.

Example:

If you’re entitled to a homestead exemption of $30,000, but a judicial lien of $10,000 impairs this exemption, you may be able to avoid the lien to protect your full exemption amount.

Eliminating Liens In Chapter 13 Bankruptcy

Chapter 13 offers additional tools:

- Lien Stripping: If you have multiple mortgages and your home’s value is less than the balance owed on your first mortgage, you can “strip” the junior liens (like a second mortgage). These liens become unsecured debts. Upon completing your repayment plan, these liens are eliminated.

- Cramdown: You can reduce the balance of certain secured debts to the current value of the collateral. For example, if you owe $15,000 on a car that’s now worth $10,000, you can reduce the secured debt to $10,000. The remaining $5,000 becomes unsecured debt and may be discharged after completing the repayment plan.

Important Limitations:

- Primary Residence: Cramdown cannot be used on mortgages secured solely by your primary residence due to restrictions in bankruptcy law (11 U.S.C. §1322(b)(2)).

- Vehicle Loans: Cramdown on vehicle loans is only available if you purchased the vehicle more than 910 days (approximately 2.5 years) before filing for bankruptcy.

- Other Personal Property: For other personal property, the debt must have been incurred at least one year prior to filing.

How To Determine The Best Bankruptcy Chapter For Your Situation

Choosing between Chapter 7 and Chapter 13 depends on several factors:

- Your Income Level: Chapter 7 has income eligibility requirements based on the means test. If your income is too high, you may not qualify.

- Types of Debts & Liens: Certain lien avoidance strategies are only available in Chapter 13.

- Your Assets: If you have significant non-exempt assets you wish to keep, Chapter 13 may offer better protection.

- Long-Term Goals: Consider whether you need immediate debt relief (Chapter 7) or have the ability and desire to repay debts over time (Chapter 13).

Consulting with a knowledgeable Honolulu bankruptcy attorney can help you make the best decision based on your unique circumstances.

Get Expert Help From Our Honolulu Bankruptcy Lawyers

Are you facing overwhelming debt and considering bankruptcy in Hawaii? Our experienced Honolulu bankruptcy attorneys are here to guide you through every step of the process. We’ll help you understand your options, protect your rights, and work towards the most favorable outcome for your financial future.

Contact us today to schedule a free consultation and join over 8,000 satisfied clients we’ve assisted in achieving debt relief and peace of mind.

Email: blake@debtfreehawaii.com

Website: https://www.debtfreehawaii.com/

HONOLULU OFFICE

900 Fort Street MallSuite 910

Honolulu, HI 96813

Phone: (808) 517-5446

AIEA OFFICE

98-1238 Ka'ahumanu StSuite 201

Pearl City, HI 96782

Phone: (808) 515-3441

KANEOHE OFFICE

46-005 Kawa StSuite 206

Kaneohe, HI 96744

Phone: (808) 515-3304

MAUI OFFICE

Our location has moved from

300 Ohukai RdSuite B317

Kihei, HI 96753

Phone: (808) 515-2037

to

220 Imi Kala St. #203B

Wailuku, HI 96793

Blake Goodman received his law degree from George Washington University in Washington, D.C. in 1989 and has been exclusively practicing bankruptcy-related law in Texas, New Mexico, and Hawaii ever since. In the past, Attorney Goodman also worked as a Certified Public Accountant, receiving his license form the State of Maryland in 1988.