Presenting Your Bankruptcy Case To Potential Lenders

Bankruptcy is often viewed as a financial fresh start, but it comes with its set of challenges, particularly when it comes to rebuilding credit and seeking new lending opportunities. If you’re in Hawaii and have experienced bankruptcy, you might find yourself in a situation where you need to explain your credit report to future lenders. Understanding the intricacies of Hawaiian bankruptcy laws and how they impact your credit report is crucial in navigating these discussions effectively.

This comprehensive guide aims to equip you with the knowledge and strategies to confidently approach lenders and secure your financial future.

Navigate Bankruptcy’s Impact on Your Credit Report with Our “2 Years to 720 Credit Score” Program

Rebuilding your credit score after bankruptcy is crucial, especially when you need to explain your credit history to future lenders. At Blake Goodman, PC, Attorney, we specialize in comprehensive credit score rehabilitation in Hawaii. Our ‘2 Years to 720 Credit Score’ program is specifically designed to support you in the credit recovery process post-bankruptcy, preparing you to effectively communicate your financial recovery to prospective lenders. With our expert guidance, you’ll not only work towards a stronger credit score but also learn how to confidently present your bankruptcy experience as a resolved chapter of your past, showcasing your commitment to financial responsibility.

Hawaii Bankruptcy Explained: Chapter 7 & Chapter 13 Effects On Credit Reports

- Chapter 7 Bankruptcy: This is a liquidation bankruptcy where certain assets might be sold to pay off debts. It can significantly impact your credit report, as it stays on your record for 10 years. However, it also allows for a relatively quick discharge of qualifying debts.

- Chapter 13 Bankruptcy: Often referred to as a reorganization bankruptcy, Chapter 13 involves a repayment plan that lasts three to five years. This type of bankruptcy remains on your credit report for seven years but shows creditors your commitment to repaying debts.

Unveiling The Effects Of Bankruptcy On Your Credit Score

Bankruptcy can substantially lower your credit score, affecting your ability to obtain loans, credit cards, and favorable interest rates. Future lenders will see the bankruptcy on your credit report, which can influence their decision-making process. However, the impact diminishes over time, especially if you take active steps to rebuild your credit.

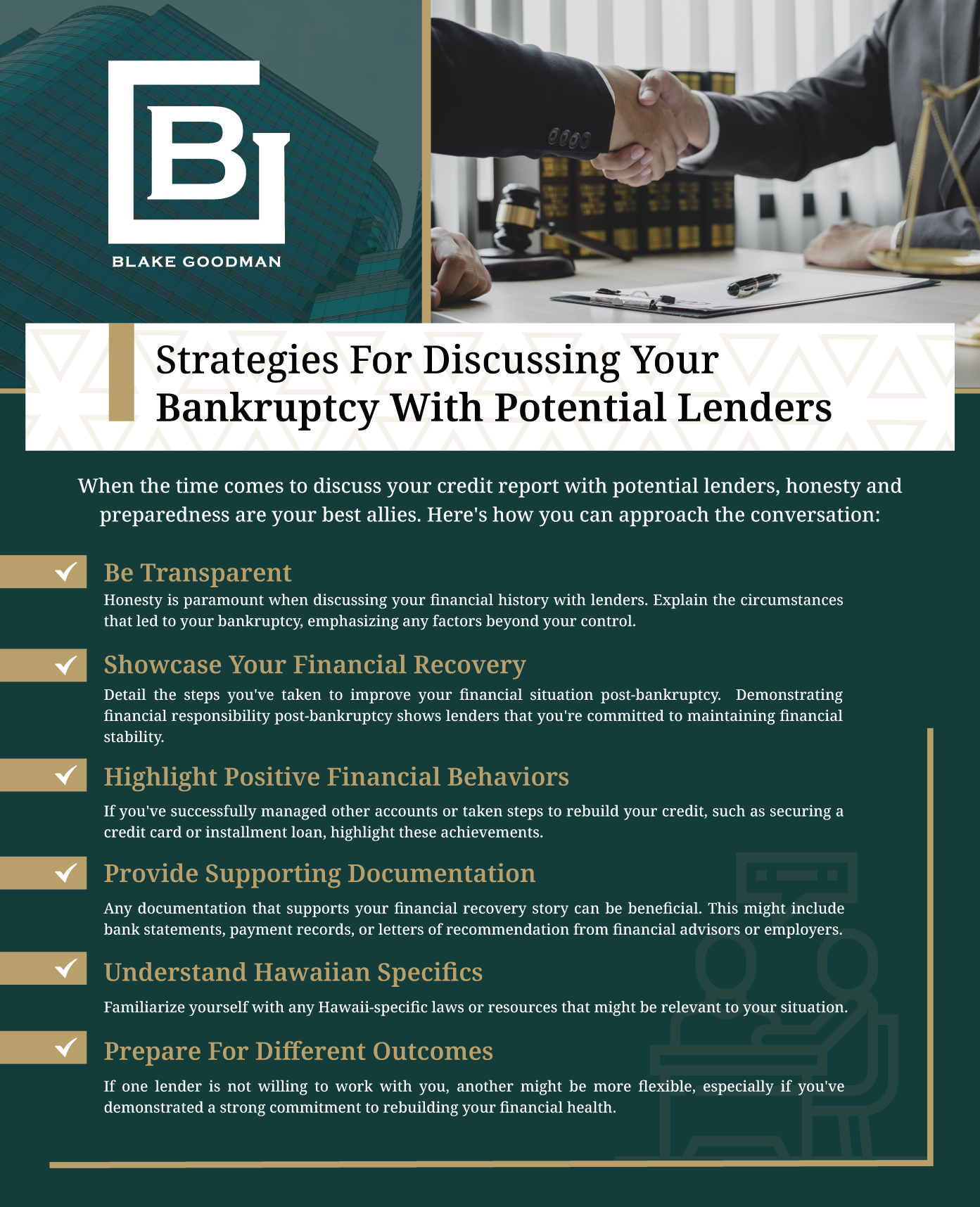

Strategies For Discussing Your Bankruptcy With Potential Lenders

When the time comes to discuss your credit report with potential lenders, honesty and preparedness are your best allies. Here’s how you can approach the conversation:

Be Transparent

Honesty is paramount when discussing your financial history with lenders. Explain the circumstances that led to your bankruptcy, emphasizing any factors beyond your control, such as medical expenses or unexpected job loss. This transparency can help lenders understand your situation better and may influence their decisions positively.

Showcase Your Financial Recovery

Detail the steps you’ve taken to improve your financial situation post-bankruptcy. This might include creating and adhering to a budget, building an emergency fund, or consistently making on-time payments. Demonstrating financial responsibility post-bankruptcy shows lenders that you’re committed to maintaining financial stability.

Highlight Positive Financial Behaviors

If you’ve successfully managed other accounts or taken steps to rebuild your credit, such as securing a credit card or installment loan, highlight these achievements. Showing a pattern of positive financial behavior post-bankruptcy can help mitigate lenders’ concerns.

Provide Supporting Documentation

Any documentation that supports your financial recovery story can be beneficial. This might include bank statements, payment records, or letters of recommendation from financial advisors or employers. Such documents can provide tangible evidence of your financial responsibility and stability.

Understand Hawaiian Specifics

Familiarize yourself with any Hawaii-specific laws or resources that might be relevant to your situation. Hawaii’s approach to exemptions, for example, might influence your bankruptcy’s specifics and how you discuss them with lenders. Additionally, local credit counseling services or financial education programs can provide further support in your journey to financial recovery.

Prepare For Different Outcomes

While some lenders may be understanding and willing to extend credit, others might be more cautious. Prepare for various responses and have a plan for each scenario. If one lender is not willing to work with you, another might be more flexible, especially if you’ve demonstrated a strong commitment to rebuilding your financial health.

Navigate Bankruptcy In Hawaii: Rebuild Credit & Trust With Lenders

Facing Bankruptcy On Your Credit Report? Connect With Blake Goodman, PC, For Expert Advice!

Explaining bankruptcy on your credit report to potential lenders can be challenging, but you don’t have to navigate this journey alone. At Blake Goodman, PC, our knowledgeable bankruptcy attorneys in Hawaii are dedicated to helping you communicate effectively with future lenders, offering insights and strategies tailored to your situation. If you’re dealing with the aftermath of bankruptcy and seeking to rebuild your financial credibility, let our team guide you.

Contact us today to learn how we can support your path to financial recovery and confidence in your interactions with lenders.

Email: blake@debtfreehawaii.com

Website: https://www.debtfreehawaii.com/

HONOLULU OFFICE

900 Fort Street MallSuite 910

Honolulu, HI 96813

Phone: (808) 517-5446

AIEA OFFICE

98-1238 Ka'ahumanu StSuite 201

Pearl City, HI 96782

Phone: (808) 515-3441

KANEOHE OFFICE

46-005 Kawa StSuite 206

Kaneohe, HI 96744

Phone: (808) 515-3304

MAUI OFFICE

Our location has moved from

300 Ohukai RdSuite B317

Kihei, HI 96753

Phone: (808) 515-2037

to

220 Imi Kala St. #203B

Wailuku, HI 96793

Blake Goodman received his law degree from George Washington University in Washington, D.C. in 1989 and has been exclusively practicing bankruptcy-related law in Texas, New Mexico, and Hawaii ever since. In the past, Attorney Goodman also worked as a Certified Public Accountant, receiving his license form the State of Maryland in 1988.