How Filing for Bankruptcy In Hawaii Stops Creditor Harassment & Protects Your Rights

On top of the constant communication, you could be facing other actions such as a foreclosure, bank levies, and more. Hawaii bankruptcy can feel like a daunting step, but if you have been fielding these calls for a long time, you may feel it is time for some help.

Declaring bankruptcy not only gets you out of a difficult financial situation, but it can also impact the calls and other harassment you get from your creditors. A bankruptcy lawyer can help you take the steps necessary towards this process.

Filing For Bankruptcy & Halting Creditor Harassment

Creditor’s can contact you in many ways to pursue the money you owe them. You may receive billing notices, phone calls, emails, and more. The contact can be constant with no end in sight, especially if you don’t have the means to pay your debts.

What’s more, if you don’t pay, the constant contact can lead to negative credit reports, legal action, wage garnishments, bank levies, property liens, and more. There is a way to stop the creditor harassment. To do this, you must file for bankruptcy.

The moment you file for bankruptcy, an automatic stay will go into place as ordered by the court. This order will force creditors to stop taking any action on your debt. An automatic stay halts the following actions:

- Foreclosures

- Phone calls and other communications

- Collection efforts

- Wage garnishments

- Bank account levies

- Repossessions

- Evictions

- Utility shutoffs

- Tax collection actions

- License suspensions

- Liens and judgments

- And more

Exceptions To What An Automatic Stay Can Impact

While most actions are halted by an automatic stay, there are some debts that cannot be impacted. Reaching out to a bankruptcy lawyer can be wise to get an idea of how bankruptcy can impact your specific debts. The exceptions to an automatic stay include:

- Criminal Proceedings: Facing fines or penalties as a part of a criminal case will not be impacted.

- Domestic Support Obligations: Child support, alimony, and custody proceedings will go on.

- Divorce & Family Law Matters: Divorce proceedings continue, but division of property may be halted if it’s part of the bankruptcy estate.

- Some Tax-Related Actions: Tax audits, demands for filing tax returns, and assessments of taxes will continue, though collection efforts will halt.

- Pension Loan Repayments: Owing money back to your retirement account will not be affected.

- Evictions: If the landlord was able to get a judgement of possession before you file for bankruptcy, you may still be evicted. However, if it wasn’t obtained before the bankruptcy, the automatic stay will delay your eviction.

When Creditors Can Get Around An Automatic Stay

Once the automatic stay is ordered with the help of your bankruptcy lawyer, all of your creditors will receive a notice of your bankruptcy. This notice will make them aware that they are no longer legally allowed to contact you. However, there are some circumstances that allow creditors to get around the stay.

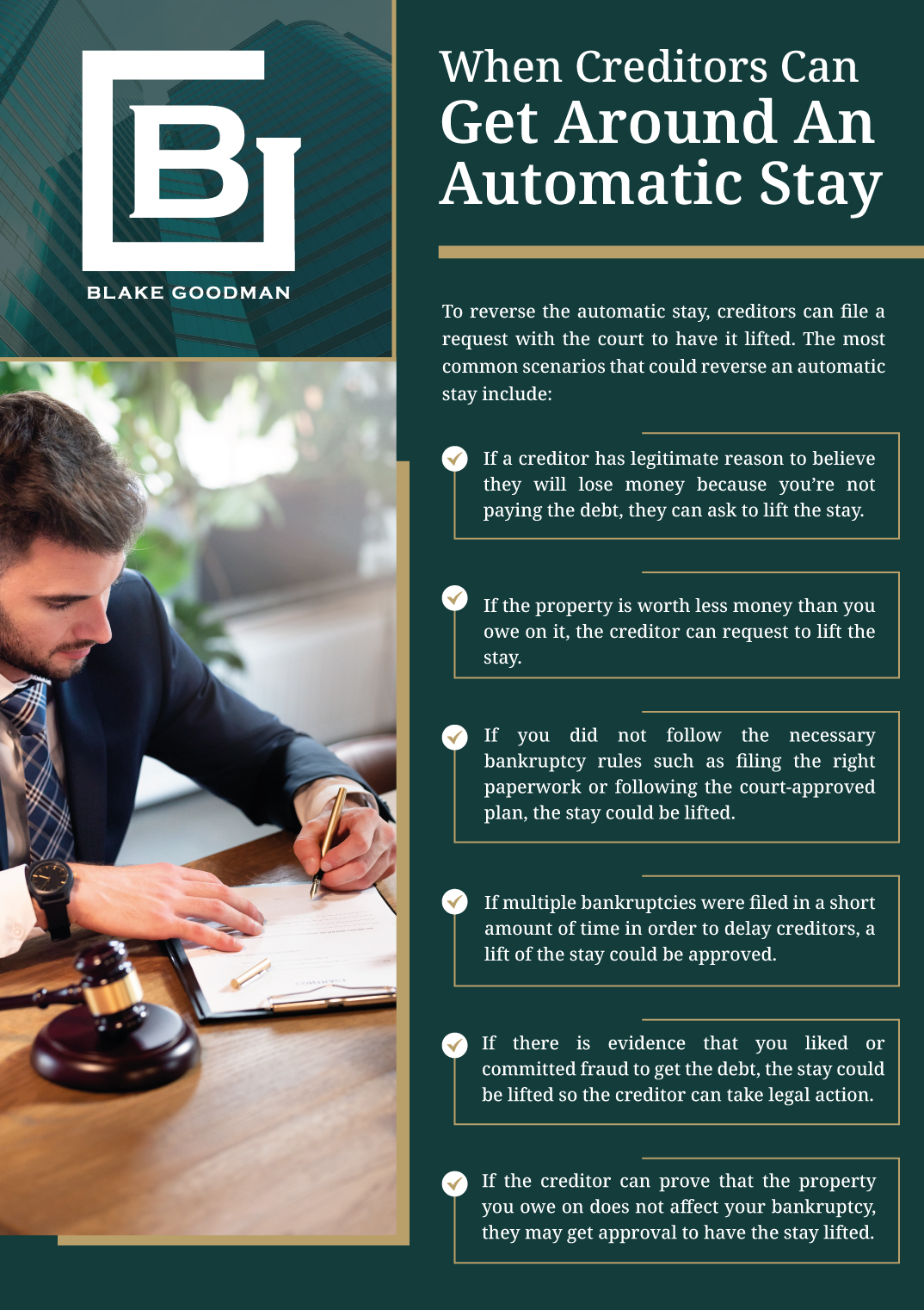

To reverse the automatic stay, creditors can file a request with the court to have it lifted. If the court agrees that it is for good reason, they may agree to reverse or modify it for that creditor. The most common scenarios that could reverse an automatic stay include:

- If a creditor has legitimate reason to believe they will lose money because you’re not paying the debt, they can ask to lift the stay.

- If the property is worth less money than you owe on it, the creditor can request to lift the stay.

- If you did not follow the necessary bankruptcy rules such as filing the right paperwork or following the court-approved plan, the stay could be lifted.

- If multiple bankruptcies were filed in a short amount of time in order to delay creditors, a lift of the stay could be approved.

- If there is evidence that you liked or committed fraud to get the debt, the stay could be lifted so the creditor can take legal action.

- If the creditor can prove that the property you owe on does not affect your bankruptcy, they may get approval to have the stay lifted.

What To Do If a Creditor Violates The Automatic Stay

- Notify them of your bankruptcy filing and provide your case number and attorney’s contact information.

- Keep records of all violations, including phone calls, emails, letters, and any other collection attempts.

- Inform your bankruptcy attorney, who can take action against the creditor.

- File a complaint with the bankruptcy court, as creditors who violate the automatic stay may face fines and legal consequences.

Start The Bankruptcy Process Today With Our Trusted Honolulu Bankruptcy Lawyers

If you’re struggling with overwhelming debt and relentless creditor harassment, filing for bankruptcy may be the best way to reclaim your financial freedom. Our Honolulu bankruptcy lawyers have the experience and knowledge to guide you through the process, ensuring that your rights are protected and that you receive the relief you deserve.

We understand that dealing with financial difficulties can be stressful, but you don’t have to face this challenge alone. Contact our bankruptcy law firm today to schedule a consultation and take the first step toward a brighter financial future.

Email: blake@debtfreehawaii.com

Website: https://www.debtfreehawaii.com/

HONOLULU OFFICE

900 Fort Street MallSuite 910

Honolulu, HI 96813

Phone: (808) 517-5446

AIEA OFFICE

98-1238 Ka'ahumanu StSuite 201

Pearl City, HI 96782

Phone: (808) 515-3441

KANEOHE OFFICE

46-005 Kawa StSuite 206

Kaneohe, HI 96744

Phone: (808) 515-3304

MAUI OFFICE

Our location has moved from

300 Ohukai RdSuite B317

Kihei, HI 96753

Phone: (808) 515-2037

to

220 Imi Kala St. #203B

Wailuku, HI 96793

Blake Goodman received his law degree from George Washington University in Washington, D.C. in 1989 and has been exclusively practicing bankruptcy-related law in Texas, New Mexico, and Hawaii ever since. In the past, Attorney Goodman also worked as a Certified Public Accountant, receiving his license form the State of Maryland in 1988.