Identifying Dischargeable Debts in Chapter 13 Bankruptcy Cases

There are many aspects of bankruptcy, but the one many people have questions about is loan discharges. Once the bankruptcy process is completed, many of your debts may be discharged or wiped out. This allows you to begin your financial journey anew. When thinking about discharging debts, the different types of bankruptcy provide different types of discharges. The benefit of Chapter 13 is that you retain your assets even as you’re able to discharge debts and certain debts that are non-dischargeable in Chapter 7, can be discharged in Chapter 13. A Chapter 13 bankruptcy lawyer can help you determine which bankruptcy option is best for you.Difference Between Chapter 7 & Chapter 13 Bankruptcy

Chapter 7 and Chapter 13 bankruptcies are two common forms of bankruptcy relief. Chapter 7, often called “liquidation bankruptcy”, involves the sale of a debtor’s non-exempt assets by a trustee to pay off creditors. Most remaining unsecured debts are discharged, giving the debtor a fresh start.

Chapter 13, known as “reorganization bankruptcy”, allows debtors to keep their assets and pay off their debts over a three to five-year period according to a court-approved repayment plan. Once all required payments are made, the court discharges the remaining eligible debts, releasing the debtor from further liability.

Chapter 7 and Chapter 13 bankruptcies are two common forms of bankruptcy relief. Chapter 7, often called “liquidation bankruptcy”, involves the sale of a debtor’s non-exempt assets by a trustee to pay off creditors. Most remaining unsecured debts are discharged, giving the debtor a fresh start.

Chapter 13, known as “reorganization bankruptcy”, allows debtors to keep their assets and pay off their debts over a three to five-year period according to a court-approved repayment plan. Once all required payments are made, the court discharges the remaining eligible debts, releasing the debtor from further liability.

Advantages Of Chapter 13 Bankruptcy Discharge: Why It’s Beneficial

When working with a Honolulu Bankruptcy Lawyer to decide which type of bankruptcy would benefit you the most, it’s important to consider the benefits of Chapter 13 over Chapter 7. The primary benefit is that Chapter 13 enables debtors to keep their property while paying off their debts over time. This is especially helpful if you’re facing foreclosure or repossession, as Chapter 13 stops those processes and allows you to create a structured repayment plan. Another reason to choose Chapter 13 bankruptcy is to protect your loan co-signers. Once you file for bankruptcy, an automatic stay will halt collection activities against you as well as your co-signers. This automatic stay is in effect as long as your case is active. Lastly, Chapter 13 takes all your loans and consolidates them into one monthly payment that is achievable for you based on income, expenses, and the types of debt you have. The payment goes to a trustee who then pays off your creditors, so you do not ever have to be in contact with your creditors.How To Discharge Your Debts With Chapter 13 Bankruptcy

Once you have paid all of the agreed-upon debt and attended a course in financial management, the bankruptcy court will issue a discharge. At this point, all of your unsecured debts that were not a part of the pay-off plan or were partially paid according to the plan will be wiped out. While many of your debts can be discharged, there are several that must be paid in full such as child support, alimony, some student loans, owed taxes, and several others. Contacting a bankruptcy attorney will help in determining which loans you will be accountable for and which can be discharged.Types Of Debts Discharged In Chapter 13 Bankruptcy

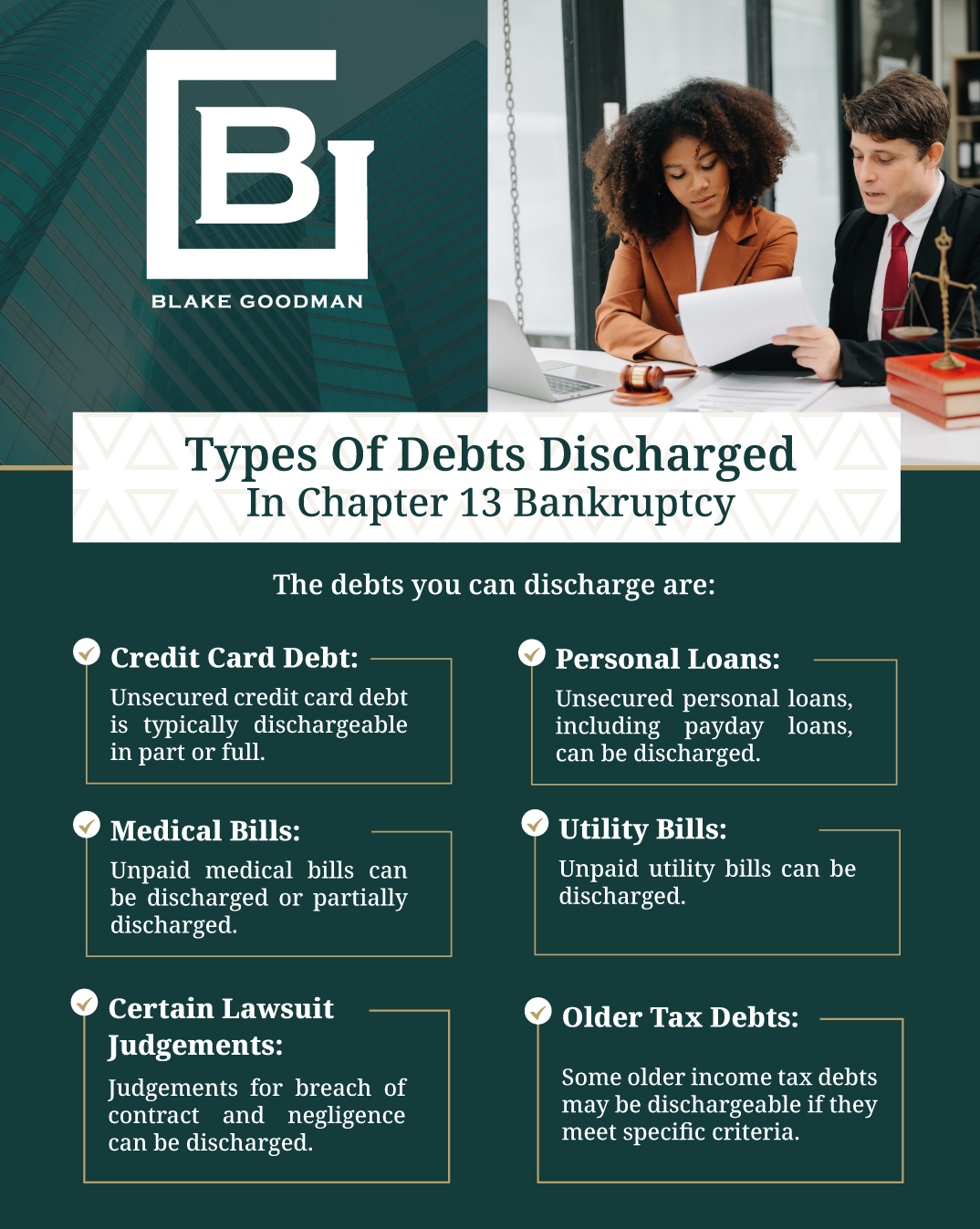

While many debts cannot be discharged in Chapter 13 bankruptcy, there are several that, under certain circumstances, will be discharged at the end of your bankruptcy process after you go through a financial management class. The debts you can discharge are:- Credit Card Debt: Unsecured credit card debt is typically dischargeable in part or full

- Medical Bills: Unpaid medical bills can be discharged or partially discharged

- Personal Loans: Unsecured personal loans, including payday loans, can be discharged

- Utility Bills: Unpaid utility bills can be discharged

- Certain Lawsuit Judgements: Judgements for breach of contract and negligence can be discharged.

- Older Tax Debts: Some older income tax debts may be dischargeable if they meet specific criteria.

Non-Dischargeable Debts In Chapter 13 Bankruptcy: What You Must Pay

In Chapter 13 bankruptcy, you are required to repay certain debts through a repayment plan approved by the court. The types of debts you will be responsible for include:Priority Debts

These must be paid in full through the repayment plan. Priority debts include child support and alimony, wages owed to employees, and certain tax obligations.Secured Debts

If you want to keep the collateral (like your home or car), you must continue making payments on these debts. The repayment plan might include catching up on any missed payments.Unsecured Debts

These include credit card debts, medical bills, and personal loans. Under Chapter 13, you typically only repay a portion of these debts, depending on your disposable income and the value of your non-exempt assets. The remaining balance is discharged at the end of the bankruptcy term.Understanding Hardship Discharge In Chapter 13 Bankruptcy

A Chapter 13 hardship discharge is a provision that allows debtors to receive a discharge of their debts under specific circumstances even if they have not completed their repayment plan. This discharge is only available under certain conditions:- Circumstances Beyond Control: The debtor must prove that they are unable to complete the repayment plan due to circumstances beyond their control. These circumstances must not be the fault of the debtor and must be significant, such as severe illness or job loss.

- Best Effort: The debtor must have paid creditors at least as much as they would have received under Chapter 7 bankruptcy liquidation. This means that if the debtor’s non-exempt assets were sold in a Chapter 7 bankruptcy, the creditors would not receive more than what they had already been paid in the Chapter 13 plan.

- Modification Not Possible: The court must find that modifying the repayment plan is not feasible. This could be due to the debtor’s inability to increase their income or reduce their expenses to make the plan payments.

If these conditions are met, the court may grant a hardship discharge, which discharges most unsecured debts. However, certain debts are not dischargeable, even under a hardship discharge.

Given that bankruptcy laws have changed recently and filing for bankruptcy can be a complicated process, contact a bankruptcy lawyer to ensure your total comprehension of the process.

If these conditions are met, the court may grant a hardship discharge, which discharges most unsecured debts. However, certain debts are not dischargeable, even under a hardship discharge.

Given that bankruptcy laws have changed recently and filing for bankruptcy can be a complicated process, contact a bankruptcy lawyer to ensure your total comprehension of the process.

Let Our Bankruptcy Lawyers Assist You As You File For Chapter 13 Bankruptcy

At Blake Goodman, we provide expert guidance to help you create a feasible repayment plan that meets court requirements and protects your assets. Our Honolulu Bankruptcy Lawyer team will handle all legal documentation and negotiations with creditors, ensuring a smooth and stress-free process. Contact us today to help you regain financial stability and protect your co-signers throughout your Chapter 13 journey.

Email: blake@debtfreehawaii.com

Website: https://www.debtfreehawaii.com/

HONOLULU OFFICE

900 Fort Street MallSuite 910

Honolulu, HI 96813

Phone: (808) 517-5446

AIEA OFFICE

98-1238 Ka'ahumanu StSuite 201

Pearl City, HI 96782

Phone: (808) 515-3441

KANEOHE OFFICE

46-005 Kawa StSuite 206

Kaneohe, HI 96744

Phone: (808) 515-3304

MAUI OFFICE

220 Imi Kala St. #203BWailuku, HI 96793

Phone: (808) 515-2037

Blake Goodman received his law degree from George Washington University in Washington, D.C. in 1989 and has been exclusively practicing bankruptcy-related law in Texas, New Mexico, and Hawaii ever since. In the past, Attorney Goodman also worked as a Certified Public Accountant, receiving his license form the State of Maryland in 1988.