Detailed Analysis Of Debt Settlement: Exploring The Advantages & Challenges

Debt is something that most everyone has. With the rising prices of living in Hawaii, it seems nearly impossible to avoid credit card debt, mortgages, auto loans, or other types of debt. Additionally, it is all too common to miss payments and end up in a cycle of not being able to keep up. However, to stop paying your debts means that you could face a debt lawsuit. If you have been contacted by a creditor looking to get their money, one of your options is to pursue debt settlement. A debt settlement lawyer can help you determine the best way to go about this to ensure your rights are protected and the outcome is in your favor. There are several initial steps that you can take in order to get started in the debt settlement process.Understanding Debt Settlement: What It Is & How It Works

Debt settlement is a strategy you can employ if you are facing significant debt burdens and are unable to keep up with your payments. The process involves negotiating with creditors who agree to allow you to pay a percentage of your debt, forgiving the rest. The goal is to relieve your financial stress by reducing your debt and avoiding more severe consequences like bankruptcy.

The process of debt settlement starts with you or a hired debt settlement lawyer initiating negotiations with the creditors. Debt settlement can be appealing to creditors who prefer to receive some payment rather than risk a debtor declaring bankruptcy, which might result in receiving nothing. Once a settlement amount is agreed upon, you will make a lump-sum payment to close the debt.

Debt settlement is a strategy you can employ if you are facing significant debt burdens and are unable to keep up with your payments. The process involves negotiating with creditors who agree to allow you to pay a percentage of your debt, forgiving the rest. The goal is to relieve your financial stress by reducing your debt and avoiding more severe consequences like bankruptcy.

The process of debt settlement starts with you or a hired debt settlement lawyer initiating negotiations with the creditors. Debt settlement can be appealing to creditors who prefer to receive some payment rather than risk a debtor declaring bankruptcy, which might result in receiving nothing. Once a settlement amount is agreed upon, you will make a lump-sum payment to close the debt.

Pros & Cons Of Debt Settlement

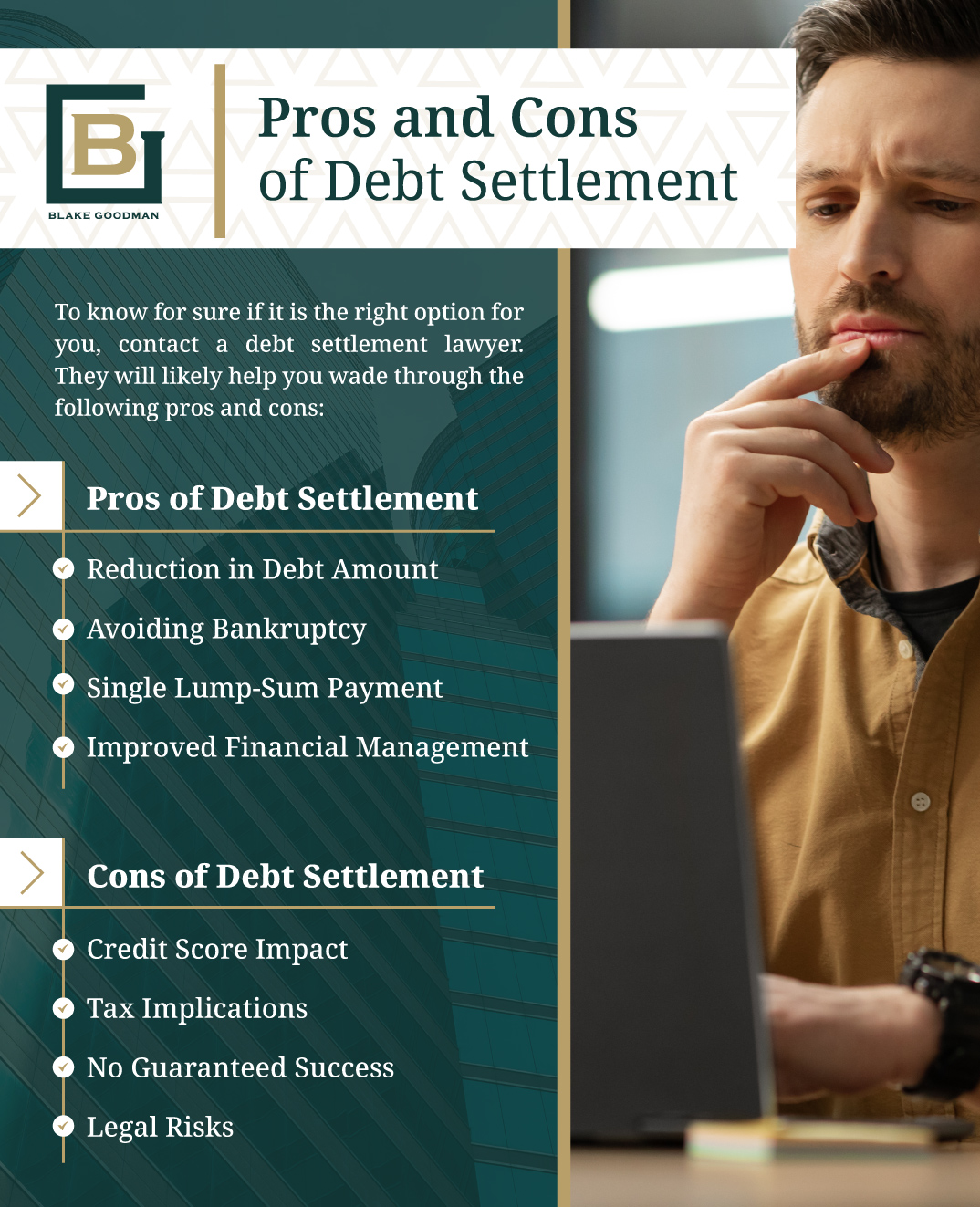

Like anything, debt settlement comes with several pros and cons. For many, it can be a helpful tool to avoid bankruptcy. For others, the impact on credit score can be overwhelming. To know for sure if it is the right option for you, contact a debt settlement lawyer. They will likely help you wade through the following pros and cons:Pros Of Debt Settlement

- Reduction In Debt Amount: The primary advantage of debt settlement is the potential to significantly reduce the total amount of debt owed. Creditors may agree to accept a lower amount than the original debt, providing financial relief to the debtor.

- Avoiding Bankruptcy: Debt settlement can be an alternative to bankruptcy, which has more severe long-term effects on credit and financial standing. Settling debts can help avoid the stigma and legal complexities associated with bankruptcy.

- Single Lump-Sum Payment: Once a settlement agreement is reached, the debtor makes a single lump-sum payment, which can simplify the debt repayment process and provide a clear end to the debt issue.

- Improved Financial Management: Successfully settling debts can help individuals regain control over their finances, potentially reducing stress and enabling better financial planning for the future.

Cons Of Debt Settlement

- Credit Score Impact: Debt settlement can negatively affect the debtor’s credit score. Settled debts are often reported as “paid less than agreed”, which can remain on the credit report for up to seven years, making it harder to obtain new credit or loans.

- Tax Implications: The amount of forgiven debt may be considered taxable income by the IRS. This means that individuals could owe taxes on the amount of debt that was forgiven, potentially leading to a significant tax bill.

- No Guaranteed Success: There is no guarantee that creditors will agree to settle the debt for less than the full amount owed. Some creditors may refuse to negotiate, leaving the debtor still responsible for the entire debt.

- Legal Risks: Creditors may pursue legal action against debtors for unpaid debts during the negotiation process. This can result in judgments, wage garnishments, or other legal consequences. It is helpful to contact a debt settlement lawyer to avoid this from happening.

Initial Steps For Starting Debt Settlement In Hawaii

If you are facing a potential lawsuit due to unpaid debts, there are a few things you can do in order to pursue debt settlement before your court date:Assess Your Financial Situation: Make a comprehensive list of all your debts, including amounts owed, interest rates, and the status of each account. From there, take a look at your income, expenses, and available assets to determine how much you can realistically offer as a lump-sum settlement.

- Understand The Debt Settlement Process: Familiarize yourself with how debt settlement works, including potential impacts on your credit score and the legal and tax implications. Decide whether debt settlement would be helpful or a detriment to your future.

- Prepare For Negotiations: Collect all relevant documents, such as account statements, loan agreements, and any correspondence with the creditors. Additionally, prepare a letter explaining your financial situation and why you are unable to pay the full amount owed. This will be useful during negotiations.

- Choose a Reputable Debt Settlement Company: Ensure the company is licensed and regulated in Hawaii. Check for accreditation from organizations like the American Fair Credit Council. Look for reviews and testimonials from other clients and check the company’s standing with the BBB.

- Start Negotiations: If handling the negotiations yourself, contact your creditors to discuss settlement options. If using a debt settlement lawyer, they will initiate contact with your creditors and negotiate on your behalf.

- Getting Settlement Agreements in Writing: Ensure that any settlement agreements reached with creditors are documented in writing. This should include the agreed-upon settlement amount and terms.

Get In Touch With Our Debt Settlement Lawyers For Effective Debt Settlement!

Our experienced Honolulu Banktuptcy Lawyers at Blake Goodman will handle all negotiations with creditors, ensuring you get the best possible settlement terms. We offer personalized strategies tailored to your unique financial situation, helping you avoid bankruptcy and regain control of your finances. Contact us today to start your journey towards a debt-free future!

Email: blake@debtfreehawaii.com

Website: https://www.debtfreehawaii.com/

HONOLULU OFFICE

900 Fort Street MallSuite 910

Honolulu, HI 96813

Phone: (808) 517-5446

AIEA OFFICE

98-1238 Ka'ahumanu StSuite 201

Pearl City, HI 96782

Phone: (808) 515-3441

KANEOHE OFFICE

46-005 Kawa StSuite 206

Kaneohe, HI 96744

Phone: (808) 515-3304

MAUI OFFICE

Our location has moved from

300 Ohukai RdSuite B317

Kihei, HI 96753

Phone: (808) 515-2037

to

220 Imi Kala St. #203B

Wailuku, HI 96793

Blake Goodman received his law degree from George Washington University in Washington, D.C. in 1989 and has been exclusively practicing bankruptcy-related law in Texas, New Mexico, and Hawaii ever since. In the past, Attorney Goodman also worked as a Certified Public Accountant, receiving his license form the State of Maryland in 1988.